Most Recent Opportunities

-

Applications are invited for the Seven-Up Bottling Company Graduate Trainee Program For Young Nigerians 2024 7up Bottling Company Ltd is a major manufacturing company in…

-

Multiple Tech Roles at onfleekQ Technologies

About us onfleekQ Technologies Limited is a Beauty Technology company utilizing technology to meet everyday consumer needs in the Beauty, Personal care and Wellness Sector.…

-

University of Manitoba Graduate Scholarship 2024/2025

University of Manitoba Graduate Scholarship award up to $72,000 to international students seeking to pursue Masters or Doctoral degree in the Canadian university. For up…

-

Nestle 2024/2025 Internships and Apprenticeship Program

Nestle Internships and Apprenticeship offers inspiring early-career opportunities to get valuable hands-on experience, mentoring and practical training in a work environment related to your field…

-

Remote Personal Assistant at Wema Bank

Job Description: We are looking for a skilled Remote Personal Assistant to join our team at Wema Bank in Port Harcourt, Nigeria. In this role,…

-

United Nations Junior Fellow Internship 2024 (Fully Funded to Tokyo, Japan)

Application Deadline: 10 May 2024 Applications are now open for the United Nations University Junior Fellows Internship Programme. The United Nations University Office of the Rector recruits highly…

-

Sterling Bank OneWoman Mentorship Program 2024

Imagine a Nigeria where women shatter glass ceilings not with a crash, but with a resounding boom. Where leadership isn’t just a title, it’s a…

-

Remote Web Design Internship at Geeky Nigeria

Company Description Geeky Nigeria is a media organization that focuses on providing news and information about technology, education, and lifestyle. Our goal is to refine…

-

UI/UX Designer at Globarman (Remote, Full time)

About Globarman At Globarman, we aim to empower tech talents to navigate relocation more clearly and affordably. We provide personalised support to help guide immigrants…

-

Wema Bank Hackaholics 5.0 ( Up to N90 million)

Join the largest community of problem-solvers, visionaries, creative thinkers and Innovators in Africa, at the annual Hackaholics Ideathon, and together, let’s catalyze change with the…

-

Multiple Recruitment at Kexco Ltd

We are a dynamic e-commerce business specializing in Product Development and Online Sales. Our mission is to deliver exceptional user experiences and drive conversions through…

-

Remote Personal Assistant at P23 Africa

Company Description P23 Africa is a company that specialises in providing tailored solutions to entrepreneurs and SMEs in Africa. Our expertise includes market entry, business…

-

Remote Customer Support Officer at Subssum

Job Title: Remote Customer Support Officer Location: Remote Company Overview: Subssum is a dynamic and innovative company committed to delivering exceptional products/services and fostering strong…

-

DevOps Engineering Summer Internship at Meetsta

About Meetsta: Meetsta is a dynamic and innovative social networking platform. Our mission is to provide a tailored and engaging space where individuals can connect,…

-

Remote Frontend Developer at World Leaves

We are looking for a versatile Front-End Developer to join our innovative team. You will be working on enhancing and maintaining our project with a…

-

Remote Blog Content Writers Needed at Microdose

Microdose Mushrooms is seeking a dynamic Freelance Blog Writer with a passion for health and wellness, specifically in the emerging field of microdosing mushrooms. This role…

-

Finance and Admin Intern Needed at Management Sciences for Health

PROJECT OVERVIEW: PMI-S is a five-year PMI/USAID flagship malaria project implemented through a consortium led by MSH. The project is supporting the Government of Nigeria…

-

Remote Content Writer (WordPress) Needed at Gravity Wiz

Are you a master of words, a curious web builder, and a believer in the magic of Gravity Forms? Gravity Wiz is seeking a full-time…

-

Call for Applications: Startupbootcamp Jumpstart Program

Join us now to help create collaborative innovation in RRP solutions that will shape a better future for consumers everywhere. Join Startupbootcamp Jumpstart today to…

-

Wema Bank/LLF Accelerator Program 2024 |N1 million equity-free funding, Mentorship and training from industry experts

A six-week training program for leather designers is being organized by Wema Bank in collaboration with Lagos Leather Fair. In an effort to promote creativity,…

-

Call for Applications: The African Union Civic Tech Fund 2.0

With great pleasure, we announce the opening of the second round of the African Union Civic Tech Fund (AUCTF), which invites innovative African projects to…

-

Peter Drucker Challenge Essay Contest 2024 for students & young entrepreneurs (€ 4,000+ cash prize).

Every year, the Drucker Society Europe and the Drucker Forum organize the Global Peter Drucker Challenge Essay Contest, an international essay competition. The Challenge examines…

-

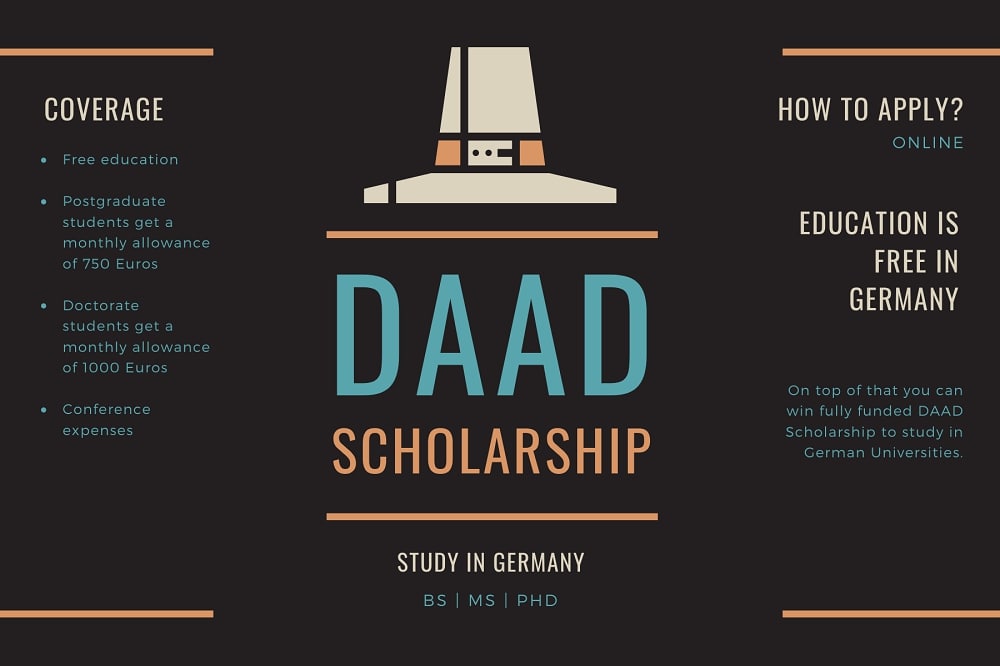

DAAD Masters Scholarship 2024/2025 for West and Central Africans

Application Deadline: June 7th, 2024 Applications are now open for the 2024 DAAD Leadership for Africa Master’s Scholarship Programme. The scholarship programme “Leadership for Africa” (LfA) aims to…

-

Call for Applications: GetBundi TechSis 2024 |Free Digital Skill Training For 1000 Nigerian women

TechSis is an initiative of GetBundi Education Foundation committed to training 10,000 African women by 2024 in various digital skill sets for free. A registered…

-

Call for Applications: LM Tech Hub Cohort Digital Skills Training Program 3.0

LM Tech Hub Cohort Digital Skills Training Program 3.0 Cohort 3.0 is the next instalment of the fellowship training programme, designed to equip students with…

-

The IFC Impact Investing Challenge 2024 for graduate students worldwide

Apply now for the 2024 International Finance Corporation (IFC) Impact Investing Challenge.The IFC Impact Investing Challenge is the premier competition for graduate students worldwide. This…

-

Call for Applications: Digital Energy Challenge for start-ups ( Up to €150K )

Each year, the Digital Energy Challenge for start-ups rewards 5 to 8 Startups developing innovative digital projects aimed at improving energy access and grid services…

-

BeChangeMaker 2024: Global Acceleration Program for Social Entrepreneurs

Applications are now open for the eighth edition of the BeChangeMake Social Entrepreneurship Acceleration Programme presented by WorldSkills and the HP Foundation and supported by UNESCO-UNEVOC. BeChangeMakeris…

-

The SME Growth Lab Africa Digital Accelerator Program 2024 for young entrepreneurs

Applications are now open for the 2024 SME Growth Lab Accelerator Program. The SME Growth Lab Africa Digital Accelerator Program is a comprehensive initiative designed to support SMEs across…

-

Call for Applications: ANIMA Soft-Landing Provence Africa Connect 2024 Program

Are you the head of an African company in the GreenTech, HealthTech, BlueTech, Cultural and Creative Industries (CCI), or Agritech? Do you have an international…

-

Call for Applications: CP Innovate Pitch and Grant 2024 ( Up to $3,000 Grant)

Innovate works to empower entrepreneurs and career professionals, equipping them with the skills and network they need to thrive. An immersive conference carefully curated to…

-

FULLY FUNDED: Apply for the second round of the IGAD Scholarship Programme for refugees, returnees and IDPs

Applications are now open for the second round of the IGAD Scholarship Programme for refugees, returnees, and IDPs. Launched in December 2021, this program is…

-

United Nations Global Compact SDG Pioneers Programme 2024 for Social Entrepreneurs

Applications are now open for the 2024 United Nations Global Compact SDG Pioneers Program. Every year, the UN Global Compact recognizes the extraordinary efforts of…

-

UNICEF Youth Advocates Programme 2024 for Young Professionals |12 month UN Volunteer Experience

UNICEF Youth Advocates Programme 2024 for Young Professionals Applications are now open for the 2024 UNICEF Youth Advocates Program. UNICEF and UN Volunteers have partnered…

-

Ongoing International Scholarships in 2024 (Undergraduate, Masters, and PhD)

Are you looking for fully-funded international scholarships to study overseas in 2024? Here are some ongoing easy-to-apply scholarships you can apply for. (Undergraduates, Masters, PhD)…

-

Standard Chartered Women in Technology Incubator Cohort 7 Program 2024 for women-led tech Kenyan startups (10, 000USD seed funding)

Applications are now open for Cohort 7 of the Standard Chartered Women in Technology Incubator. Standard Chartered Women in Technology Incubator Kenya is Africa’s leading…

-

Flat6Labs/Organon Women’s Health Accelerator Program 2024 for Femtech startups

Applications are now open for the 2024 Flat6Labs/Organon Women’s Health Accelerator Program. The Women’s Health Accelerator Program, launched by Flat6Labs and Organon, a global healthcare company, aims…

-

Women for Africa Foundation Learn Africa Scholarship Programme 2024/2025 for young African women

Applications are now open for the Women for Africa Foundation Learn Africa Scholarship Programme. Requirements General requirements Be a woman, and have nationality and residence in an African…

-

MIT Africa Empowering the Teachers Fellowship Program 2025/2026

The MIT-Empowering the Teachers Program (MIT-ETT) is a semester-long fellowship for engineering professors who are currently teaching at Nigerian universities and have recently completed their…

-

CV template

If you’re seriously searching for a paid internship, this message is for you. Dear friends, Are you desperately searching for a paid internship but can’t…